How to Choose the Right ACA Healthcare Plan

Every year, the federal Affordable Care Act (ACA) opens enrollment for health insurance coverage application from November 1 through December 15. When you sign up for health insurance during this time, your coverage will start the following January 1. Then, if you sign up after December 15 through January 15, your coverage will begin the following February 1.

While we recommend to

connect with a health insurance broker who can walk you through all your options and help you find the most affordable plan for your unique healthcare needs, you can also use these tips when you’re looking for health insurance coverage through the ACA.

Key Takeaways

- The Affordable Care Act (ACA) offers health insurance plans for individuals and families in the United States. If you don’t get health insurance through work, or you’re looking for other options, the ACA may offer more affordable care for the services you need than what you’re currently getting with a health insurance plan.

- Open enrollment for ACA health insurance begins November 1, 2024. If you sign up by December 15, 2024, your coverage will start January 1, 2025. If you sign up after December 15, 2024, and by January 15, 2025, your coverage will begin February 1, 2025.

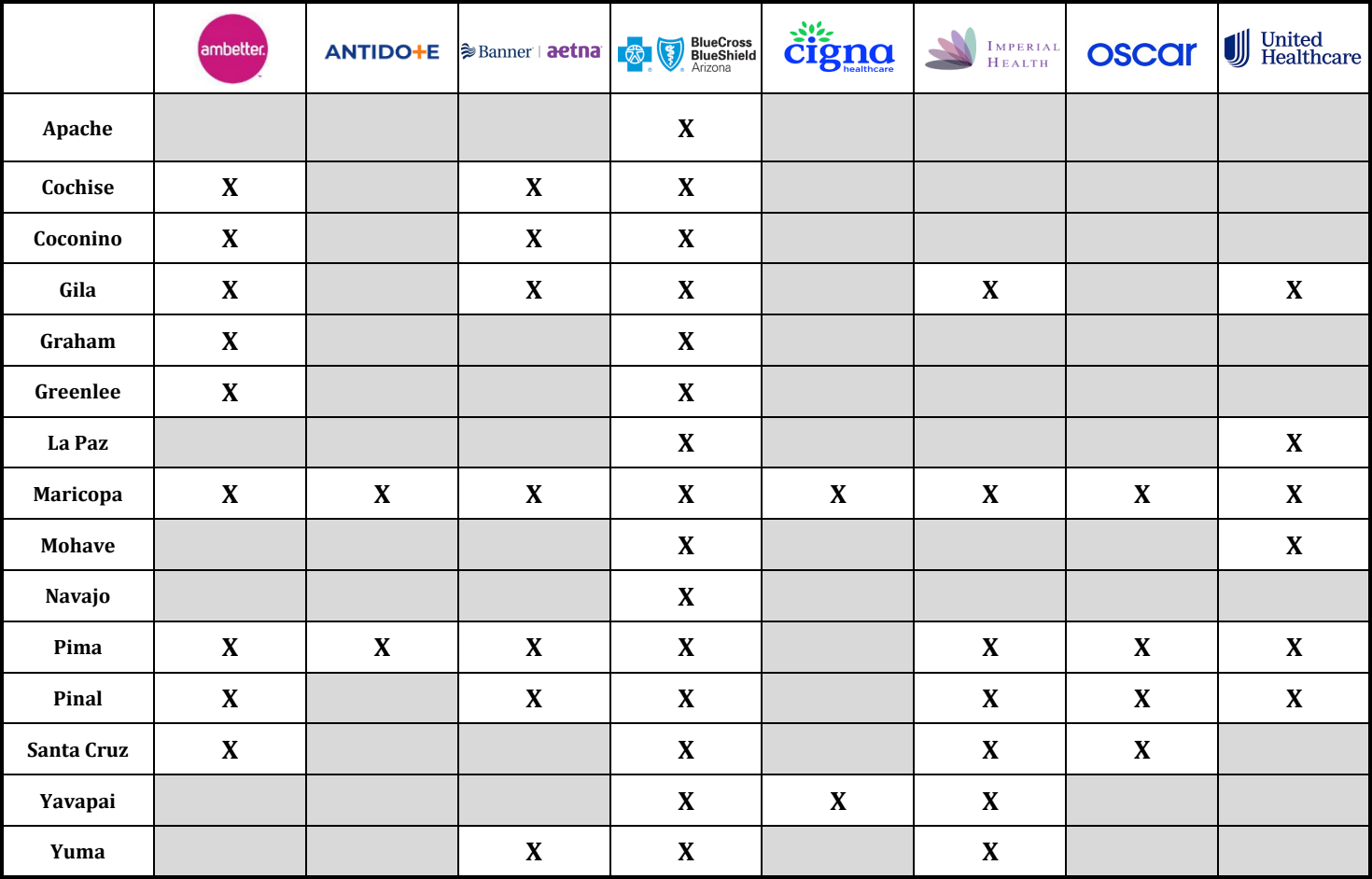

- Available ACA healthcare providers in Arizona depend on what county you live in. Use the

ACA Healthcare form to find healthcare providers in your area and to compare all your options, as well as to get free personalized assistance from an insurance expert to guide you through the sign-up process.

First: What Is the Affordable Care Act?

The Affordable Care Act went into effect in 2010. It helps “make affordable health insurance available to more people”. Part of achieving that mission is to offer subsidies, also known as premium tax credits, to households with incomes up to 400% of the federal poverty level when they purchase ACA health insurance.

The ACA also expanded Medicaid program coverage to adults who have income below 138% of the federal poverty level. This helps more people obtain Medicaid coverage, which is federally funded healthcare coverage for people with unique needs.

Some people may choose ACA coverage even when they don’t fall into groups like those above. ACA healthcare plans may be a convenient option for people who don’t receive healthcare coverage through their employer, or if they’re self-employed, for example.

What ACA Healthcare Providers Are Available in Arizona?

ACA coverage and related providers depend on the county you live in. For example, here’s a sampling of insurers in Arizona’s two most-populated counties.

- For Maricopa County, providers include: Ambetter, Antidote, Blue Cross Blue Shield, Banner Aetna, Cigna, Imperial, Oscar and UnitedHealthcare. *Medica exits for 2025*

- For Pima County, providers include: AMBetter, Antidote, Banner Aetna, Blue Cross Blue Shield, Imperial, Oscar, and UnitedHealthcare.

- For Pinal County, providers include: AMBetter, Banner Aetna, Blue Cross Blue Shield, Imperial, Oscar, and UnitedHealthcare.

All ACA healthcare plans provide coverage for essential healthcare needs, including ambulatory and emergency care, hospitalization, pediatric services, preventive and wellness services, laboratory services, rehabilitative services and more.

It’s important to know that if you’re considering getting an ACA plan, even if you stay with the same insurer you’ve previously had, say, with an employer, not all doctors are in-network with ACA healthcare plans. You can call your preferred doctor’s office to check if they’ll accept your health plan, or you can call the Marketplace Call Center at 1.-800.-318.-2596 for help.

If you need health insurance, but your preferred doctors don’t provide coverage under the ACA, you still have options. You can get a private insurance plan for yourself or your family any time of year, including outside of ACA open enrollment.

How to Select an ACA Plan

During open enrollment, you can go to this website to browse health insurance plans available to you based on your ZIP code. Health insurance coverage through the ACA is available in bronze, silver, and gold tiered categories.

- Bronze: A bronze plan typically requires paying around 40% of your healthcare costs, while the insurance company will typically pay around 60% of your healthcare costs. Bronze plans offer the lowest monthly premium but will cost the most when you need care. They’re a good choice if you are relatively healthy and you don’t anticipate major healthcare costs. If you want coverage for worst-case medical scenarios but want to keep your monthly costs the lowest possible, this is an ideal plan.

- Silver plan: A silver plan will typically require plan holders to pay about 30% of healthcare coverage, while the insurance company will cover around 70% of healthcare costs. Plan holders will have a higher monthly premium than a bronze plan, but the costs on healthcare deductibles will be lower. If you visit the doctor periodically, a silver plan could save you money. There may also be cost-sharing reductions available that could help you save on a silver plan, as well. Silver policies are most popular for people that qualify for a CSR (cost sharing reductions).

- Gold plan: A gold plan will have a higher monthly premium than bronze and silver plans, but you’ll have lower costs when you need care. On gold plans, the health insurer typically pays 80% of costs, while the insured pays 20%. Gold plans may be a good choice if you use a lot of care, since the deductible is typically lower that bronze and silver plans.

The ACA also offers catastrophic health plans for select populations. These plans have low monthly premiums and very high deductibles. They’re available for people who are younger than 30 years old, as well as for others who qualify for an affordability or hardship exemption.

Put simply, if you anticipate having relatively fewer medical costs, a bronze or silver plan can lower your premium costs and provide you with the basic coverage you need. If you get frequent medical care, a gold plan may make more sense.

Have a Health Savings Account? You Can Still Get an ACA Plan

Now’s a good time to mention a health savings account, or HSA. An HSA works similarly to a flexible savings account. It’s used for healthcare costs. Employees whose employers offer an HSA can add money to their account and use those tax-free contributions to pay for healthcare costs.

If you know you’re going to need coverage for out-of-pocket expenses your health insurance won’t cover (like going to a naturopathic doctor or miscellaneous expenses for example), or you need extra funds to pay for healthcare costs toward your deductible, you can use HSA pre-taxed funds for those expenses.

This is a popular option if you know you’ll meet your deductible for a surgery or for maternity needs, and they generally have a lower out-of-pocket maximum. You can have both an HSA and an ACA high deductible health plan, so having both could be a good option when you’re considering coverage when you factor in monthly premiums and your out of pocket maximum.

ACA Open Enrollment Is Here: Research Plans Now

If you’re considering an ACA plan, don’t miss out on open enrollment. You can visit here to look up plans you qualify for in your area. You can also search doctor names to filter plans that are in- network with your doctor(s).

Have questions about ACA plans? The AZ Health Insurance Brokers team is here to help. Give us a call at 602.617.4107, email us at quotes@azhealthinsurance.com or contact us by filling out the form online.

ACA Healthcare FAQs

What is the Affordable Care Act (ACA)?

The Affordable Care Act (ACA) is the federal government’s health insurance program for individuals and families in the United States. During open enrollment, you can sign up for a health insurance plan through the ACA and get coverage within a month or two.

When is ACA open enrollment?

ACA open enrollment begins November 1, 2024, and lasts through January 15, 2025. If you sign up by December 15, 2024, your coverage begins January 1, 2025. If you sign up after December 15, 2024, and by January 15, 2025, your coverage begins February 1, 2025.

What if I miss ACA open enrollment?

If you want an ACA health insurance plan, but you miss open enrollment, you may qualify for a special enrollment period. ACA special enrollment period qualifying events include getting married, having a baby, adopting a child, placing a child for foster care, getting divorced, getting legally separated and losing health insurance, if someone on your Marketplace plan dies, moving, losing job-based health insurance and losing individual health coverage. You typically have 60 days to sign up for ACA health insurance coverage after the qualifying event occurs.

What health insurers are on the ACA Marketplace in Arizona?

In Arizona, ACA Marketplace health insurers include Ambetter, UnitedHealthcare, Blue Cross Blue Shield, Banner|Aetna, Cigna, Oscar, Antidote Health, and Imperial. Use the free ACA Marketplace health insurance form to get a list of ACA health insurance providers in your area.

How much do I have to pay for ACA health insurance?

You have a variety of ACA Marketplace plans with various price points to choose from. Each insurer on the ACA Marketplace offers health insurance plans on various “metal” tiers, including bronze, silver, gold and platinum. Each metal tier designates how much the insurer pays versus how much the insured will pay for healthcare coverage. The tier type will determine the monthly premium. Talk with a health insurance representative if you have questions about which metal tier makes sense for your unique financial situation.