What Is an Irrevocable Life Insurance Trust? Pros & Cons of ILITs

An irrevocable life insurance trust (ILIT) is a powerful estate planning tool that can hold a life insurance policy and pass the death benefits to heirs, completely free of income and estate taxes. With an ILIT, the owner of the trust can leverage the annual gift tax exclusion, with gifts being used to pay life insurance premiums in the trust, which can be a significant financial advantage. With tax exemption limits for estate taxes anticipated to be drastically decreased in 2026, now may be a good time to consider an ILIT for your family’s estate planning strategy.

There are both pros and cons to using an ILIT to ensure your loved ones are protected should you or your spouse pass away. This guide explains what an ILIT is, advantages and disadvantages of an ILIT, and what using an ILIT might look like.

Key Takeaways

- An ILIT protects a grantor’s term life insurance or permanent life insurance premiums and death benefits from being subject to estate and income taxes.

- By using an ILIT, a family can ensure their beneficiaries get access to funds without having to sell high-value assets to cover expenses after death. ILITs are generally considered legacy-building tools, rather than financial planning tools for the here and now.

- While the 2017 Tax Cuts and Jobs Act (TCJA) raised the federal estate tax exemption maximum amounts to $27.22 million per couple and $13.61 million per person, in 2026, those limits are expected to be reset to $5 million indexed to inflation, approximately $7 million, in January 2026. That means, this year is an ideal time for individuals and families to consider using an ILIT as part of their financial planning strategy.

Irrevocable Life Insurance Trusts Explained

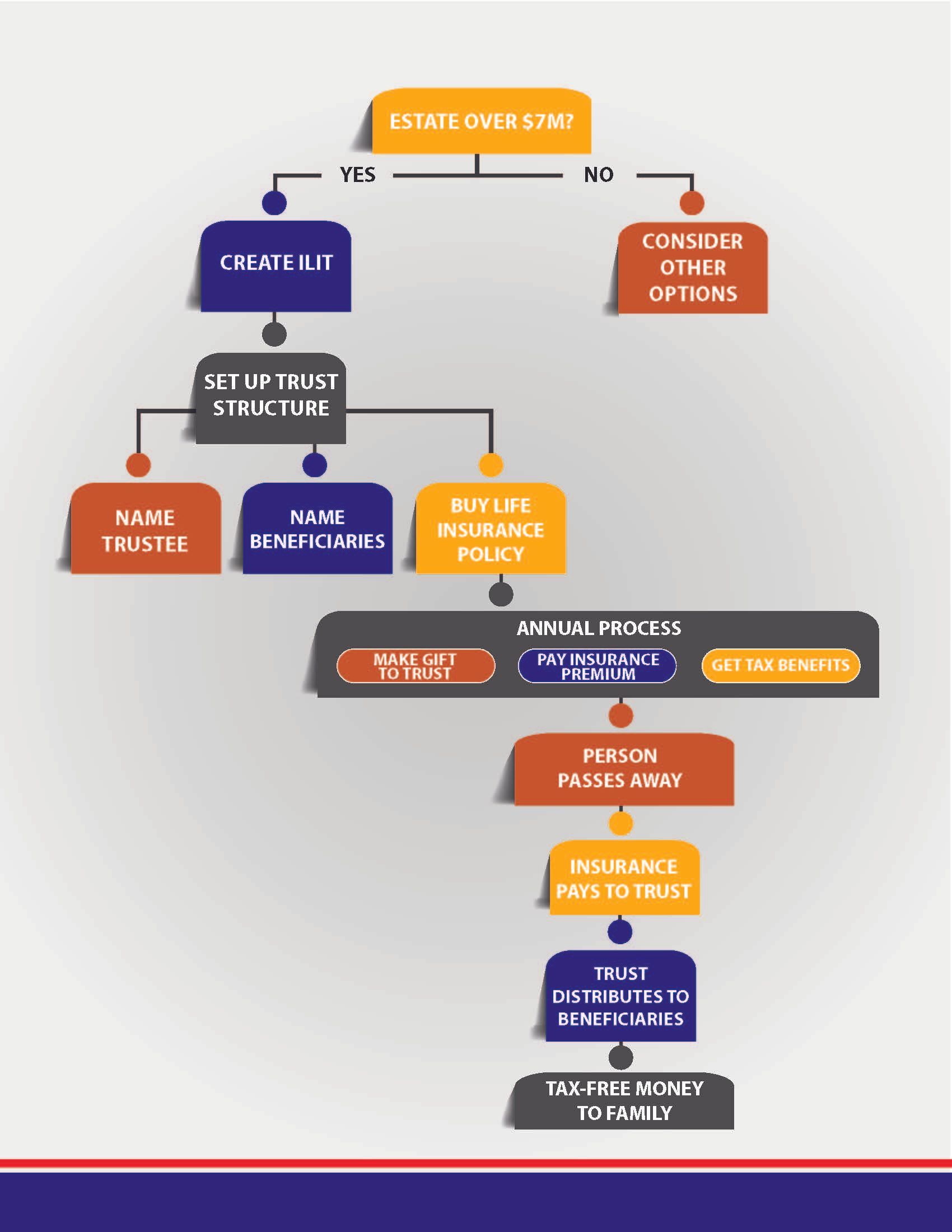

An ILIT is a trust that’s created to hold

life insurance, where the trust owns the life insurance policy, rather than an individual. An ILIT is separate from the grantor’s estate and isn’t included in the estate’s value.

Typically, the grantor will pay the trust. The trustee will use those funds to pay life insurance premiums. When the grantor passes away, the trustee receives the

life insurance payout and distributes the funds to the life insurance beneficiaries.

Like the name implies, an ILIT is irrevocable. That means, once it’s established, it typically can’t be terminated or altered. Because of the permanent aspects of this type of financial tool, the grantor should be completely sure it’s the type of financial vehicle they’d like to use.

Pros of Irrevocable Life Insurance Trusts

The main benefit of ILITs, especially in 2025, is that this type of trust can minimize taxes for the grantor and their family. Some reasons to consider using an ILIT include:

- Minimize estate taxes: Usually, the death benefits of a life insurance policy will be included in the gross estate. With an ILIT, the death benefit proceeds aren’t a part of the gross estate, so they’re not subject to federal and state estate taxes. This means, proceeds from an ILIT could even be used to help pay estate taxes, which makes an ILIT a strong financial protection tool for beneficiaries who may be left having to pay estate taxes and other expenses once the grantor passes away.

- Avoid gift taxes: In an ILIT, contributions by the grantor are considered gifts. This enables the grantor to leverage the annual gift tax exclusion of $19,000 per beneficiary in 2025, when the gifts are used to pay premiums on the life insurance in the trust. Married couples who file jointly can give an individual up to a combined $38,000 in 2025 without having to pay gift taxes.

- Control over death benefits: Grantors can use the trust document to determine how and when they want their life insurance policy death benefit to be used and for which beneficiaries. This helps with legacy planning, as an ILIT also helps take advantage of the grantor’s generation skipping transfer tax (GSTT) exemption if they want to name people who are more than 37.5 years younger than them (such as grandchildren) as beneficiaries.

- Avoid probate: Another major benefit of using a trust is that your family will avoid probate and legal action in court about the distribution of your assets. This can lessen the burden of losing a loved one for a family, since finances have already been managed prior for protection against issues like divorce and creditors.

For families of individuals who may be subject to considerable taxation, an ILIT can help the grantor and their family avoid taxes now and in the future. As the temporary tax cuts from the 2017 TCJA are expected to reset in 2026, a wider income bracket will mean more people will have to pay more federal estate taxes. An ILIT can mitigate this development.

Cons of Irrevocable Life Insurance Trusts

ILITs are lifetime commitments once they’re created. They may not always make sense depending on your unique situation. Consider these potential cons.

- Permanence: Once the terms of an ILIT are signed, they’ usually can’t be revoked or changed. This presents a level of risk to the grantor, who usually won’t be able to change their mind regarding the terms in the future.

- Potential taxation: If the grantor passes away within 3 years of the creation of an ILIT, the ILIT’s life insurance policy may be included in the estate. If that happens, the payout could be subject to estate taxes.

- Loss of policy ownership: Once your life insurance policy is integrated in an ILIT, you surrender ownership and control of the policy to the trust and trustee. Again, you won’t be able to make changes to the life insurance policy once it’s part of an ILIT.

If you feel comfortable with the terms of an ILIT, it can be a positive financial vehicle for you and your family. But if you want the ability to make changes to your life insurance policy in the future, you may want to explore other options.

Example of an ILIT in Action

For a look at how an irrevocable trust might play out, here’s an example of a couple that might be considering one.

John, 54, and Lisa, 52, have a $26 million estate and three children. They’re aware that under current laws, their estate wouldn’t be subject to estate taxes if they both passed away today. However, they also know that current tax laws are set to change on January 1, 2026, potentially cutting the lifetime estate tax exemption in half. This change could expose a significant portion of their estate to estate taxes.

Thankfully, John and Lisa still have time to create a plan to protect their wealth from unnecessary taxes while the exemption remains at its current high level.

John and Lisa’s Estate Overview

Here’s a breakdown of John and Lisa’s estate:

- $19 million in privately held stock and real estate

- $7 million in other assets, including their home, retirement accounts, bank savings and investments

So far, John and Lisa haven’t used any of their lifetime tax exemptions or made annual gifts to their children. They also aren’t ready to give away ownership of their stock or real estate just yet, but they still want to find a way to minimize future taxes on their estate.

The Challenge for John and Lisa

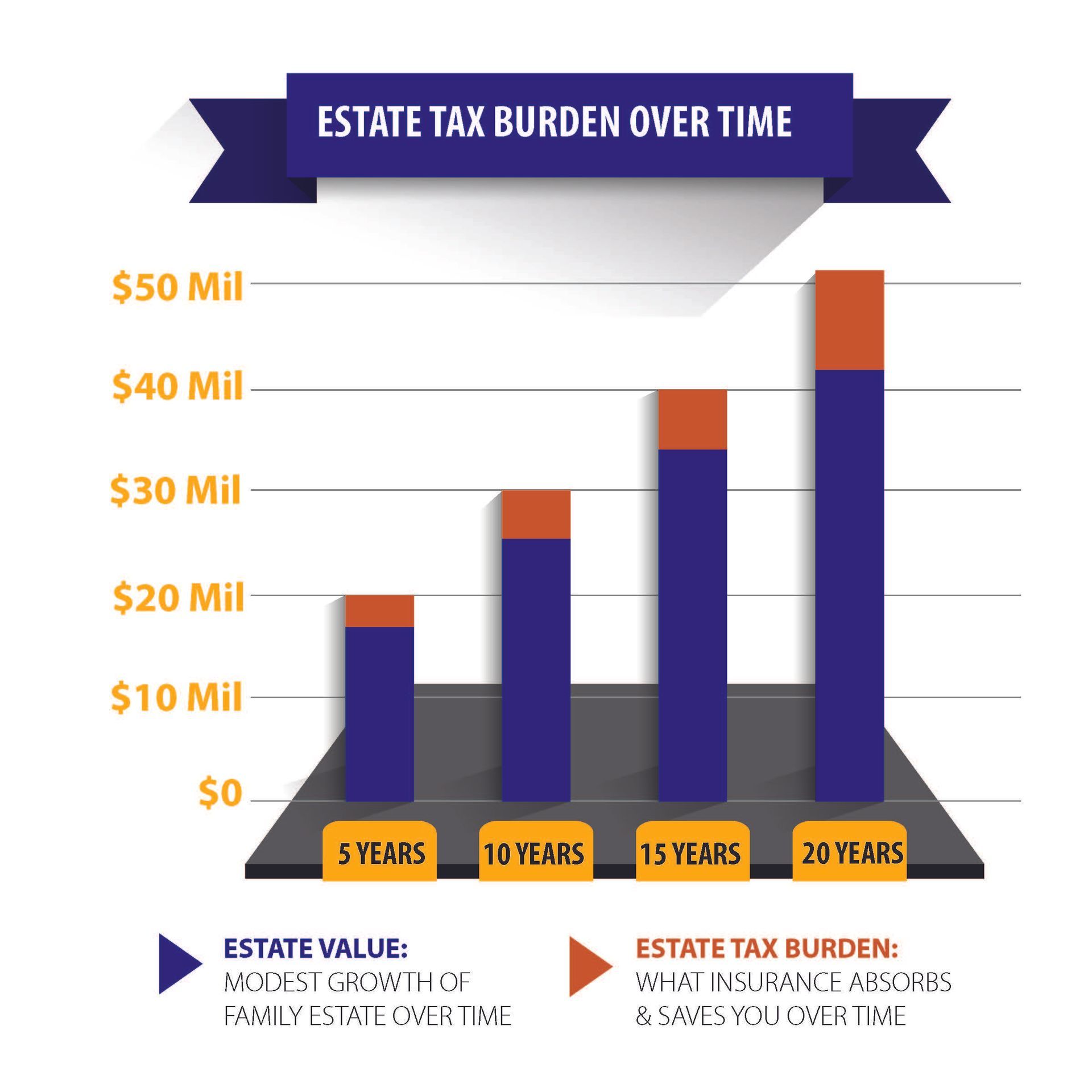

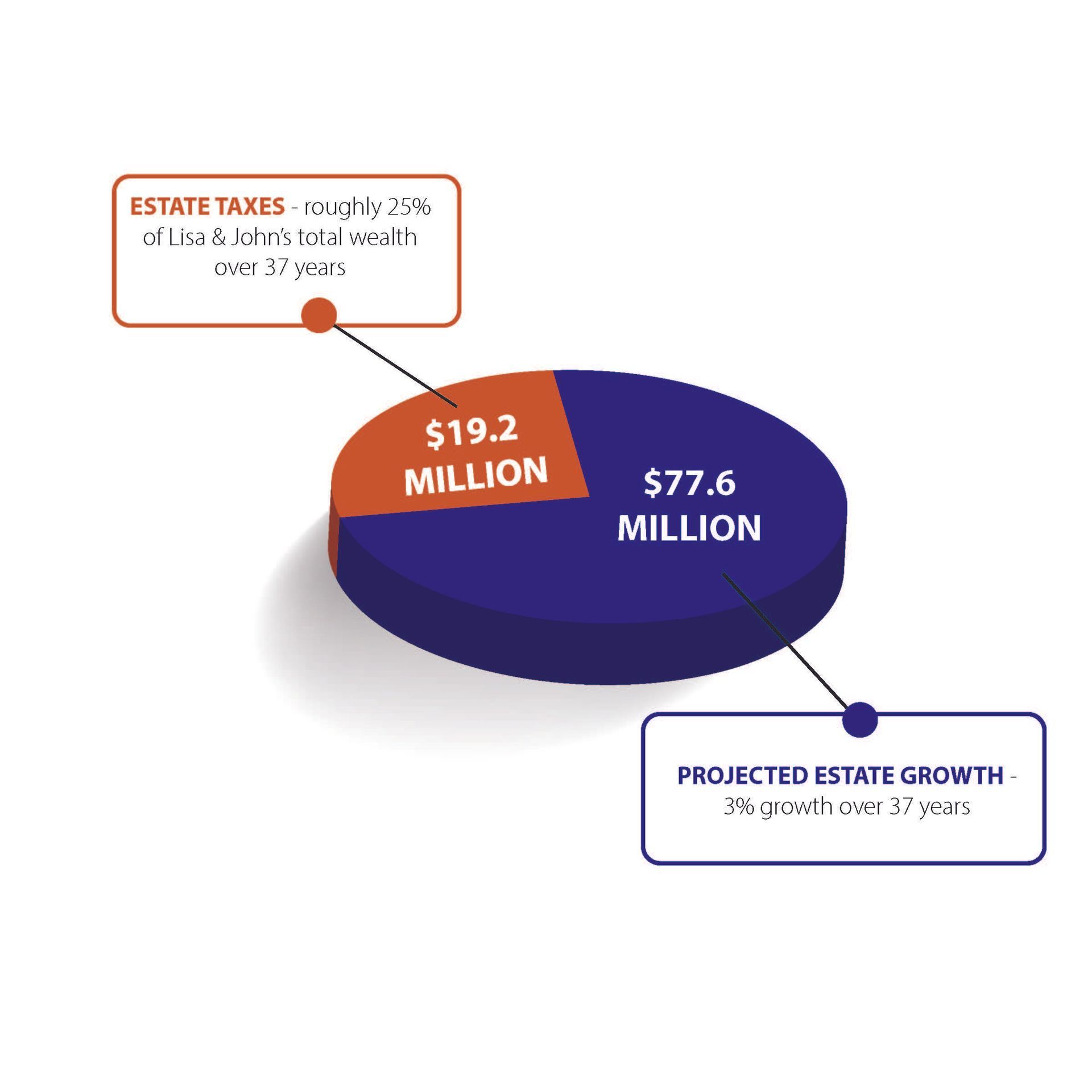

If John and Lisa’s estate grows at a modest 3% annual after-tax rate, their wealth could increase to $77.6 million by their life expectancy in 37 years. Under current tax laws, this could result in $19.2 million in estate taxes – about 25% of their total wealth.

To protect their estate, John and Lisa are considering an ILIT. This strategy creates a tax-efficient way to transfer significant wealth to their children.

Exploring Solutions

To evaluate the benefits of an ILIT, John and Lisa considered purchasing a $15 million survivorship life insurance policy. This type of policy pays a death benefit when the second spouse passes away, providing the family with liquidity to cover estate taxes and other costs.

The couple analyzes four payment options for funding the policy:

- A single payment up-front

- Payments spread over 10 years

- Payments spread over 20 years

- Payments spread evenly until Lisa turns 100 years old

Each option was reviewed to determine which approach would have the greatest financial benefit, while minimizing the impact on their annual gifting limits and lifetime exemption.

The Best Strategy for John and Lisa

After reviewing the options, the 10-year payment plan emerged as the most efficient way for John and Lisa to transfer wealth to their children. Here’s how the plan works.

- John and Lisa would make annual gifs of $108,000 to the ILIT over 10 years. This amount comes from the annual gift tax exclusion of $18,000 per child, per parent, for their three children.

- They would also use $75,000 of their lifetime exemption each year to cover the premiums, for a total of $750,000 over 10 years.

By funding the ILIT this way, they ensure that the $15 million life insurance policy will be fully paid in 10 years, without significantly impacting their overall estate.

Alternative Strategy for Comparison

John and Lisa also considered a more conservative approach: using only the $108,000 annual gifts to fund the policy, without tapping into their lifetime exemption.

Under this plan, it would take 18 years of annual gifts to fund the same $15 million policy. While this approach avoids using any of their lifetime exemption, it extends the funding period and delays the benefits.

John & Lisa’s Final Decision

After careful consideration, John and Lisa chose the 10-year gifting strategy. Here’s why:

- The 10-year plan allows them to transfer the greatest amount of wealth to their children.

- It protects their estate from the high costs of future estate taxes.

- The life insurance proceeds provide the liquidity needed to cover taxes and estate expenses without forcing the family to sell assets.

- The ILIT ensures the proceeds are distributed according to John and Lisa’s wishes, providing peace of mind and financial security for their heirs.

Why an Irrevocable Life Insurance Trust Works

An irrevocable life insurance trust is a powerful tool for families like John and Lisa, who want to:

- Reduce estate taxes

- Protect their wealth for future generations

- Maintain control over how their assets are distributed

By acting now, John and Lisa are taking advantage of today’s favorable tax laws to secure their family’s financial future.

Need Help Deciding If an ILIT Is Right for You? Call the AZ Life Insurance Experts

Our team can help you explore financial arrangements, including life insurance policies and life insurance retirement plans (LIRPs), that help protect your family now and in the future. We can help you select a life insurance plan, such as a whole life insurance policy, term life insurance or universal life insurance policy, and determine how life insurance fits in with your estate planning.

To learn more about your options regarding life insurance, call the AZ life insurance experts at 602.617.4107, or contact us online.

Irrevocable Life Insurance Trust (ILIT) FAQs

What is an irrevocable life insurance trust (ILIT)?

An ILIT is a trust for a life insurance policy. It’s irrevocable, which means once it’s set up, you’re typically not able to make any changes over the life of the trust.

Can you dissolve an ILIT?

No, because an ILIT is irrevocable, the ILIT terms are typically permanent. This means, it’s not likely you’ll be able to dissolve an ILIT once you establish one.

How is an ILIT different from a regular life insurance policy?

With a regular life insurance policy, the individual who takes out the policy is generally the owner of the policy. With an ILIT, the trust owns the policy, and the trustee manages the policy. There are numerous tax benefits an ILIT offers, such as minimized estate and gift taxes.

What are the pros of an ILIT?

An ILIT can shield the grantor and their family from estate, GSTT and gift taxes, now and in the future. ILITs also provide legacy planning benefits and help families avoid probate regarding life insurance benefits payouts.

What are the cons of an ILIT?

An ILIT is generally unchangeable once it’s established. This presents a level of risk to the grantor, should issues like divorce occur, or if the grantor later wants to make changes to a life insurance policy.